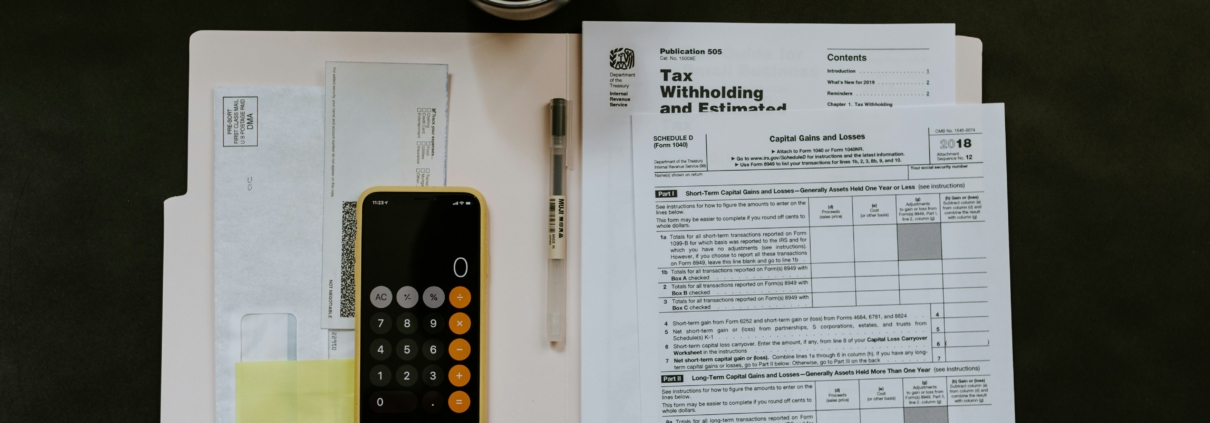

As the IRS tax filing deadline approaches, independent contractors, freelancers, and self-employed individuals need a clear, simple, and effective plan to file taxes on time and maximize deductions. That’s why we created a free checklist — for Schedule C tax filers who are required to file a 1040 return.

Whether you’re in rideshare, eCommerce, content creation, or another form of self-employment, this guide is designed to help you get organized and reduce stress during tax season.

✅ 1040 form and Schedule C Tax Prep Checklist: What to Bring to Your Appointment

Before we dive into the workflow, here’s a simple list of documents to gather for your tax appointment:

🔒 Identification & Personal Info

-

Government-issued photo ID

-

Social Security Number (or ITIN)

💵 Income Records

-

All 1099 forms (NEC, MISC, K)

-

Digital payment app records (Cash App, PayPal, Venmo, etc.)

-

Personal records of business income (invoices, deposits)

📊 Business Expense Documents

-

Receipts for advertising, supplies, software, and other tools

-

Mileage log or rideshare app summary

-

Home office expenses (rent, utilities, square footage)

📆 Prior Year Return

-

Last year’s 1040 + Schedule C for reference

📝 Pro Tip: Organizing digital receipts in a Google Drive or Dropbox folder by category can save time and money when you meet with your preparer.

💬 Why This Matters

According to Forbes, self-employed Americans often leave money on the table by missing deductions or waiting until the last minute. (Source: Forbes – Tax Mistakes to Avoid).

A Cosmopolitan article also noted that gig workers tend to “under-report income because they’re unsure how to track it all.” (Source: cosmopolitan.com)

Our local team in North Miami Beach makes sure that doesn’t happen to you.

💻 Book Your Appointment Today

Ready to file with confidence? Let’s get started.

📅 Click to Schedule: Book with Désir

📞 Call Us Now: (305) 707-7238

📧 Email: info@whoisdesir.com

🎥 Want to Learn More?

Check out these helpful YouTube videos:

🔗 More Resources

Tax season doesn’t have to be stressful. Our proven tax prep checklist will make it easy for Schedule C filers in North Miami to stay ahead of the IRS deadline and keep more of what they earned.